What is shared equity?

Using shared equity to buy your property

Why wait around trying to save a large deposit for a home? Secure a home loan with shared equity and enter the property market sooner.

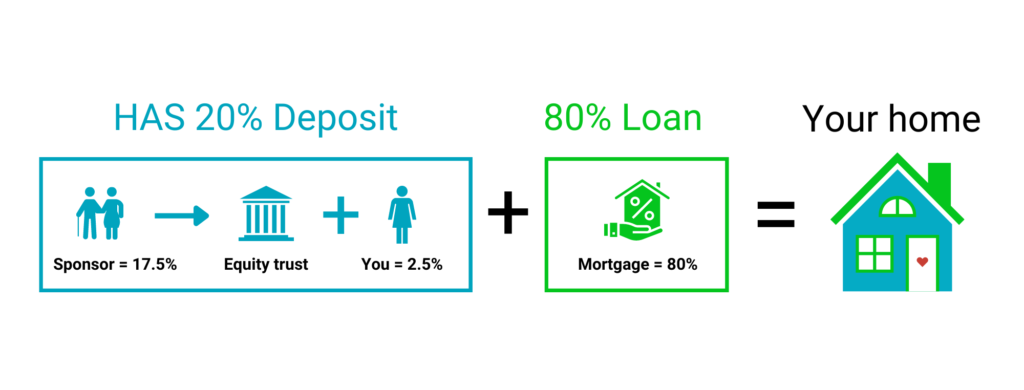

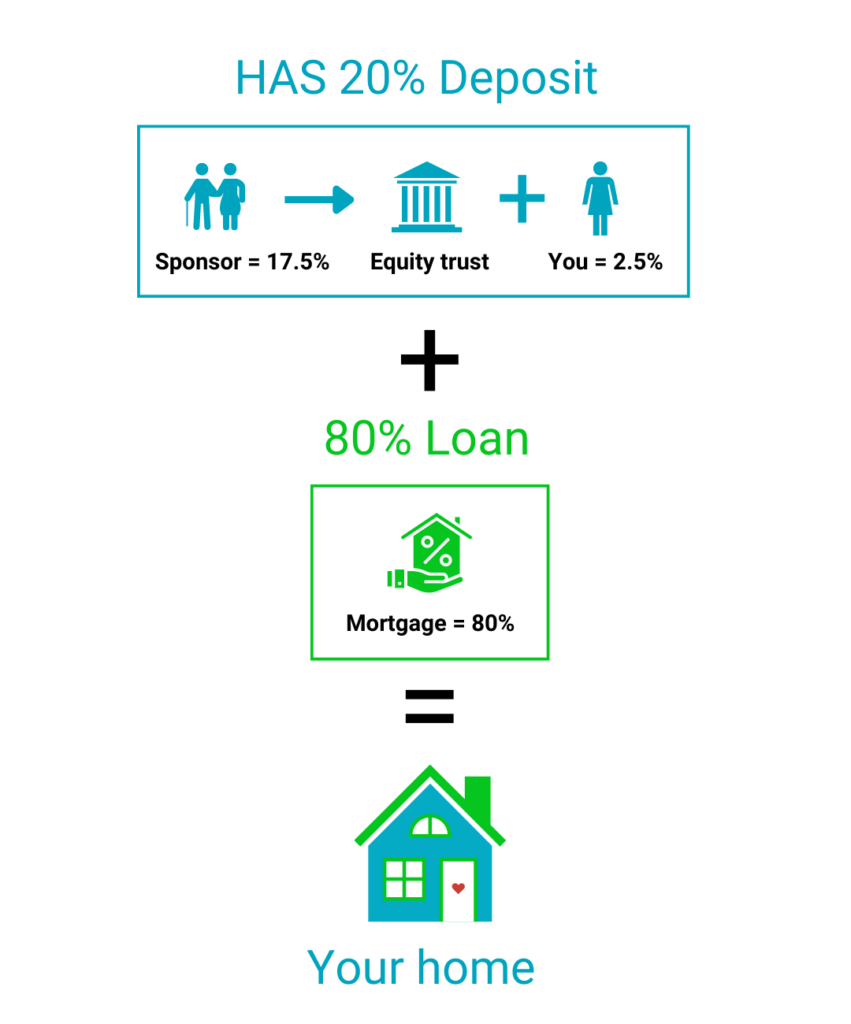

All you need is a 2.5% home loan deposit and a sponsor to invest alongside you. HAS shared equity provides the remaining 17.5% to bring your deposit up to 20%. With the other 80% portion of your loan sitting with a bank, you avoid costly Lenders Mortgage Insurance (LMI).

With HAS shared equity, you also enjoy reduced monthly repayments across the first five years of your loan. You are still entitled to First Homeowner Grant and stamp duty concessions, as and when they apply.

Sponsors can enjoy a return on their investment. Parents acting as sponsors can help you secure a property, without the risk of a parental guarantee home loan.

Parents can enjoy a return on their investment, without the risk of a parental guarantee home loan.

What is shared equity?

There’s plenty to like about HAS shared equity. It can boost your deposit (you put in 2.5%, we put in 17.5%), reduce the strain of servicing your mortgage, and help create intergenerational wealth to pass down within your family.

Discover more about how HAS shared equity can help you achieve your property dream.

Benefits of shared equity

Only 2.5% required

HAS shared equity provides a great way to boost your deposit, which starts at a minimum of 2.5%. Government grants can also be used towards this deposit.

5 yrs - 3.25% fixed interests

Enjoy 3.25% fixed interest on your loan’s shared equity portion, for five years. With sponsorship, shared equity percentage can increase to 37.5%, to aid serviceability.

No LMI

required

With no lender’s mortgage insurance required, you make a big saving. LMI can add thousands to your mortgage, costing between $10,000 and $40,000 on average.

Out of the rent cycle

Welcome to the ‘rent buster’. HAS shared equity helps you break out of the rent trap, avoiding eight-ten years of saving for a traditional deposit.

Can I buy a home loan with no deposit?

Maybe you want to know how to get a home loan with no deposit.

While HAS shared equity still requires a 2.5% deposit made up of your own funds, you can use any available government grants to make up your 2.5% portion.

So, while it’s not a first home buyers loan with no deposit, your micro deposit can be put together using any First Home Owner Grant or stamp duty concessions you may be eligible for.

Who is it for?

HAS shared equity offers low deposit home loans for first home buyers, single parent home loans, and rent-busting options for single parent first home buyers.

– Young professionals: It can be hard for young professionals to break into the property market, despite hard work, a good job and promising prospects. HAS shared equity offers access to low deposit home loans for first home buyers, taking advantage of First Home Buyer Grants and concessions to make up a micro deposit.

– Single parents: It’s notoriously difficult for single parents to find a way out of the rent trap. HAS shared equity offers an easier, more affordable entry to the property market, with access to a single parent home loan.

It’s a great way for divorcees and single mums to get back on their feet after loss or divorce.